What Are Tariffs and Why Do They Exist?

Tariffs1 are taxes on imported goods. Governments use them to regulate trade and protect domestic manufacturing industries. By making foreign goods more expensive, tariffs encourage companies to buy from local & domestic suppliers and distributors.

The goal is to strengthen American manufacturing. By increasing the cost of imported steel and aluminum, the U.S. government aims to boost domestic production.2 However, higher costs can also impact industries that rely on these materials. These tariffs aim to reduce reliance on foreign metals. The goal is to strengthen the U.S. steel and aluminum industries. However, businesses that rely on imports may face higher costs. This change could reshape global supply chains.

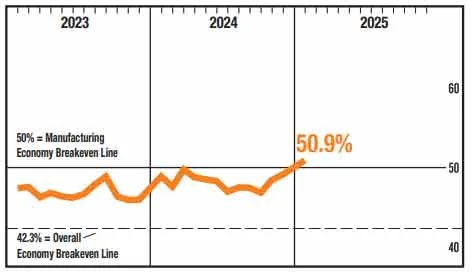

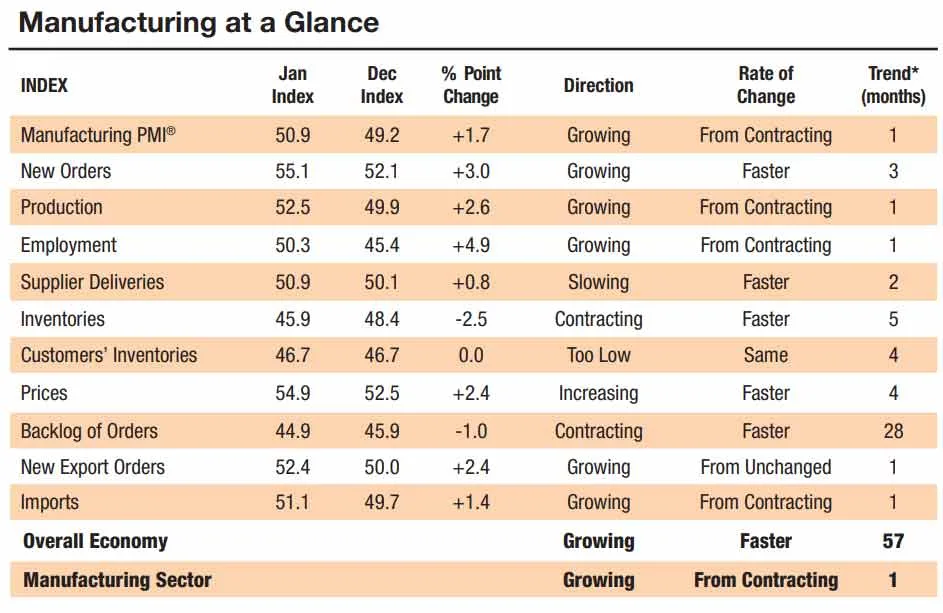

U.S. manufacturing grew in January for the first time in over two years. The Manufacturing PMI hit 50.9%, up from 49.2% in December. This marks a shift after 26 months of decline.

Four key areas—New Orders, Production, Employment, and Supplier Deliveries—showed growth. In December, only two were expanding. This signals a stronger manufacturing sector heading into the year.

The New Tariff Policy

Starting March 12, 2025, the U.S. will impose a 25% tariff on all imported steel and aluminum. The previous rate was 10%, with some country exemptions. Now, all trading partners must pay the full rate.3

This includes imports from Canada, Mexico, the European Union, Japan, and South Korea. Previously, these countries were exempt under older trade agreements. Now, they face the same tariffs as other nations.

The new policy builds on past trade measures. China already faced high tariffs under previous administrations. Now, every country will pay the same rate, regardless of past agreements.

Global Trade Impact

Experts claim that these tariffs will increase costs for manufacturers using imported metals. It is also worth noting that prices in the latest manufacturing PMI report had an increasing rate of growth and have expanded 4 months consecutively. Companies in the auto, construction, and packaging industries will be affected. Some may raise prices, while others may look for new suppliers.

Countries impacted by the tariffs may retaliate. They could impose tariffs on U.S. exports, leading to new trade disputes. This could affect American businesses selling products abroad.

Supply chains will need adjustments. Companies may shift sourcing strategies, buying from new suppliers or increasing domestic production. This change could reshape global trade patterns.

What should Businesses do?

With the March 12 deadline approaching, businesses should prepare. Taking proactive steps now can minimize disruptions and unexpected costs.

- Assess Import Costs – Identify affected products and calculate the financial impact of these new tariffs.

- Explore Alternative Suppliers – Look at domestic distribution options to reduce reliance on taxed imports.

- Ensure Compliance – Understand the new tariff rules to avoid delays or penalties.

- Monitor Trade Developments – Stay updated on possible policy changes or new exemptions.

The new tariffs will have widespread effects on global trade and U.S. manufacturing. While they aim to strengthen domestic industries, they will also raise costs for some importers. Businesses must adapt and pay attention to this latest tariff update to avoid financial strain.

Stay informed and plan ahead to navigate these changes effectively. The situation may evolve, so we recommend all shippers to keep an eye on policy updates.

- Economists debate the impact of tariffs on trade and industry. Some argue tariffs protect domestic manufacturing by leveling the playing field. Countries like China operate with lower labor costs, minimal workplace regulations (such as OSHA), and fewer environmental or safety standards for products like plastics. Without tariffs, U.S. manufacturers compete against foreign producers who do not face the same compliance costs, making it harder for American industries to thrive. ↩︎

- Expert analysts argue tariffs increase consumer prices by raising import costs. However, supporters of tariffs counter that keeping money within the domestic economy boosts economic activity rather than sending funds abroad. The velocity of money—the rate at which money circulates—could rise, potentially benefiting domestic businesses and workers. ↩︎

- The strength of the U.S. dollar also plays a key role. A weaker dollar makes U.S. exports more competitive globally, offsetting some of the negative effects of tariffs. Conversely, a strong dollar could make American goods more expensive for foreign buyers, limiting export growth. Ultimately, the impact of tariffs depends on broader economic conditions, trade relationships, and currency fluctuations. ↩︎