Macroeconomic Shifts Reshape Supply Chains

June 2025 brings a complex mix of policy, inflation, and consumer dynamics. The U.S. government imposed sweeping tariffs earlier this year, targeting key trade partners—China, Mexico, and Canada. These trade actions, paired with retaliatory measures abroad, continue to impact supply chain costs and reshape global sourcing decisions.

The State of Logistics Report, produced for the Council of Supply Chain Management Professionals (CSCMP), highlights that U.S. business logistics costs rose by 5.4% to $2.58 trillion,1 maintaining a share of 8.8% of GDP for the second consecutive year. While 2024 was marked by relative post-pandemic stability, the report underscores a return to uncertainty heading into 2025, driven by emerging tariff policies and geopolitical risks.

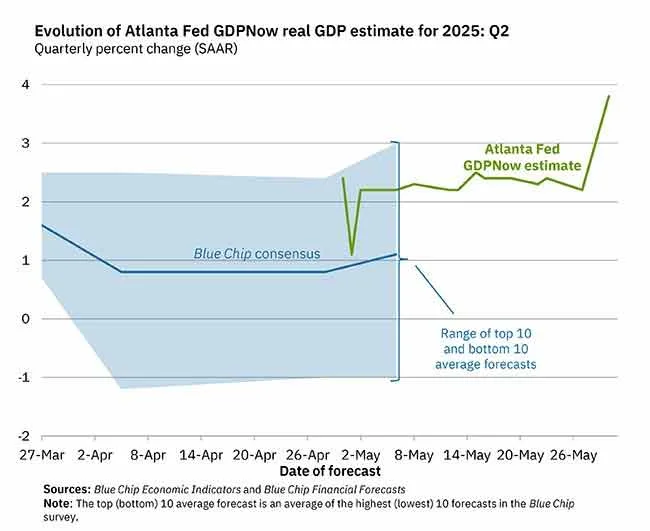

Sectoral analysis reveals marginal recovery in motor freight and warehousing as will be explored further below, but notes that ports and air freight will see a pullback in activity and pricing due to softened demand and easing disruptions. The report forecast modest GDP growth of 1.7–1.8% in 2025, cautioning that this outlook depends heavily on how tariffs unfold. As global dynamics shift, the report stresses that logistics resilience is no longer optional, but must become a core strategic imperative enabled by AI, automation, and sustainable process design.

The Atlanta Fed’s GDPNow model now estimates 3.8% annualized growth for Q2 2025. This jump follows strong U.S. trade data from April. The GDPNow model is a real-time economic tracker that uses incoming data to estimate U.S. GDP growth before official numbers are released.

Slowing Domestic Growth and Cautious Consumers

The U.S. economy contracted by 0.2% in Q1 2025, reversing a 2.4% gain in Q4 2024.2 Consumers have remained resilient, but momentum in growth is slowing according to consensus. May’s Consumer Sentiment Index remained flat at 52.2, down nearly 25% from a year ago.3 Inflation expectations stayed elevated at 6.6%, reflecting widespread concerns about future price increases.

Spending also slowed. April retail spending rose just 0.2%, down from 0.7% in March. This happened despite an 0.8% rise in wages. At the same time, consumers increased their savings rate by 0.6%. This behavior suggests that shoppers may have frontloaded purchases to avoid tariffs earlier in the year and are now bracing for future uncertainty.

On Wall Street, May was a strong month for stocks—though optimism faded near the end. A new 50% tariff on steel and aluminum imports was announced on May 30th.4 This doubled the previous 25% level and cast doubt on earlier hopes for trade resolution. President Trump assured the public that relations with China could improve, but geopolitical tensions remain high.

On the consumer front, confidence declined for the fourth straight month in March, before holding steady in May.5 Shoppers now face higher prices and fear even more instability, namely contracting growth. Consumer sentiment is near a 12-year low, reflecting growing discomfort with inflation, borrowing costs, and uncertainty about global trade policy. That uncertainty is already cooling spending in sectors like automotive and appliances.

Trucking Market Enters a Transitional Phase

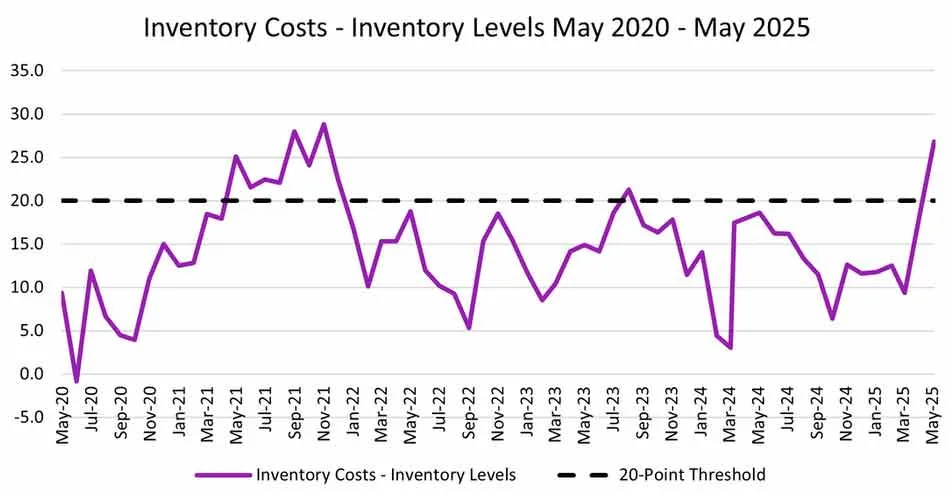

According to the May 2025 Logistics Manager’s Index (LMI), overall activity in logistics is growing.6 The LMI rose to 59.4, a sign of industry expansion. However, much of this growth comes from rising costs rather than increased volume. Inventory Costs surged to 78.4—its highest point since October 2022—despite falling Inventory Levels.

Warehousing dynamics tell a similar story. Utilization remains high while available space is shrinking. Warehousing Capacity dipped to exactly 50.0 in May, a threshold that signals no change. At the same time, Warehousing Prices stayed elevated at 72.1. These metrics suggest that shippers are holding costly inventory with limited options to expand storage. Further rate hikes now depend on whether factory demand rebounds or manufacturing continues to drag under policy pressure.

Trucking capacity has tightened considerably. Since late 2022, roughly 38,000 operating authorities exited the market. Smaller fleets continue to shutter as inflation squeezes margins, and large fleets have contracted capacity generally by around 5%. Meanwhile, trucking employment has fallen year-over-year for 22 consecutive months, indicating fewer available drivers and reduced overall fleet size.

Transportation capacity and pricing held relatively steady in May. Utilization hovered at 52.6, while Transportation Prices showed further growth at 63.1. Tight labor markets and regulatory uncertainty continue to keep carriers cautious. The market has entered a state of expansionary concerns—with higher costs, but not necessarily higher throughput.

Manufacturing Slows as Inventories Pile Up

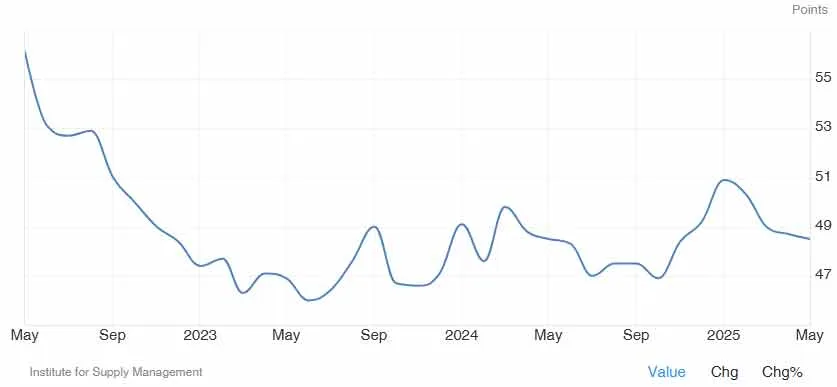

The manufacturing sector showed renewed weakness in May. The ISM Manufacturing PMI registered 48.5,7 indicating contraction. This marks the third consecutive month of accelerating decline. Key subindices—Production, Employment, and Inventories—continued to fall. Only Supplier Deliveries remained in expansion territory.

High input costs, high interest rates and weak demand are reshaping production schedules. Many firms are pulling back on capital investment and labor hiring. Factory output dipped as a result, with companies waiting for better clarity on tariffs and inflation. The manufacturing lull is now visible across supply chains, from raw materials to finished goods.

Inventory data reinforces this cooling trend. Inventory Levels fell 5.5 points in May to 51.5, barely indicating growth. Meanwhile, Inventory Costs jumped 2.8 points to 78.4 according to the LMI report. The 26.8-point gap between these measures is one of the highest on record. A similar spread last occurred during the COVID-era inventory surge—and it eventually led to months of inflation and logistics gridlock.

Meanwhile, the Federal Reserve has kept interest rates steady for two straight meetings following three consecutive rate cuts in late 2024. The target range now sits at 4.25%–4.50%. The Fed’s March 2025 projections reflect expected slower growth and rising core inflation, driven in part by retaliatory tariffs and constrained consumer demand.8

Global Trade Policy June Update

Tariff unpredictability has redefined global trade strategy.9 Today, uncertainty is no longer an anomaly — it’s a baseline for business planning.10 The 50% tariff announced in late May is set to take effect on July 4th.11 Shippers, once confident that trade restrictions would ease, are now in wait-and-see mode.

Many importers rushed goods into U.S. ports in Q1, anticipating tariff hikes. Now, inventory levels are bloated, and warehousing is expensive. Port executives, like Gene Seroka at the Port of LA, say they do not expect another COVID-style import boom.12 Today’s conditions lack the consumer stimulus and pent-up demand that fueled that historic surge, this is exhibited within the consumer confidence index.

There’s reason for caution. Import costs are already high, especially from China and other major exporters. With uncertainty surrounding whether the most extreme tariffs will actually go into effect—or how long they will last—shippers are hesitant to make long-term decisions.13 That pause in strategic planning could ripple through global supply chains well into 1H of 2026.

Citations

- “State of Logistics Report” highlights growing uncertainty after a year of relative stability ↩︎

- US Economy Shrinks 0.2% on Weaker Spending, Larger Trade Impact ↩︎

- Surveys of Consumers – University of Michigan ↩︎

- Trump doubles steel tariffs to 50%, slams ‘shoddy’ Chinese products while celebrating Nippon’s $14B investment in America ↩︎

- University of Michigan Consumer Sentiment Index ↩︎

- Logistics Managers Index ↩︎

- ISM Manufacturing Report On Business ↩︎

- Federal Open Market Committee Minutes ↩︎

- McKinsey & Company ↩︎

- There’s Nowhere to Hide as Tariffs Reshape Global Trade ↩︎

- Donald Trump’s steel and aluminum tariffs expected to push up import costs by $100bn ↩︎

- Tariff truce will not spark cargo boom at busiest US seaport, executive director says ↩︎

- Air cargo’s “wait and see” approach to US tariffs and positive demand outlook for 2025

↩︎