Truck tonnage rises 3% in February, marking the second straight year-over-year gain and signaling a transportation sector rebound.

Strong Growth in Truck Tonnage

Truck tonnage rose 3% in February. This marks the second consecutive year-over-year increase. The American Trucking Associations (ATA) reported the tonnage index reached 115.2, up from 111.9 in January. This increase suggests the freight market is gaining momentum.

The index also showed a 0.6% rise compared to last year. This is the first time in over a year that the market has posted consecutive annual gains. Stronger freight demand and improved economic conditions contributed to this growth.

Despite the gains, the not seasonally adjusted index fell 4.7% to 104.8. This reflects raw changes in freight volume. Seasonal trends and pre-tariff shipping likely played a role in the fluctuations.

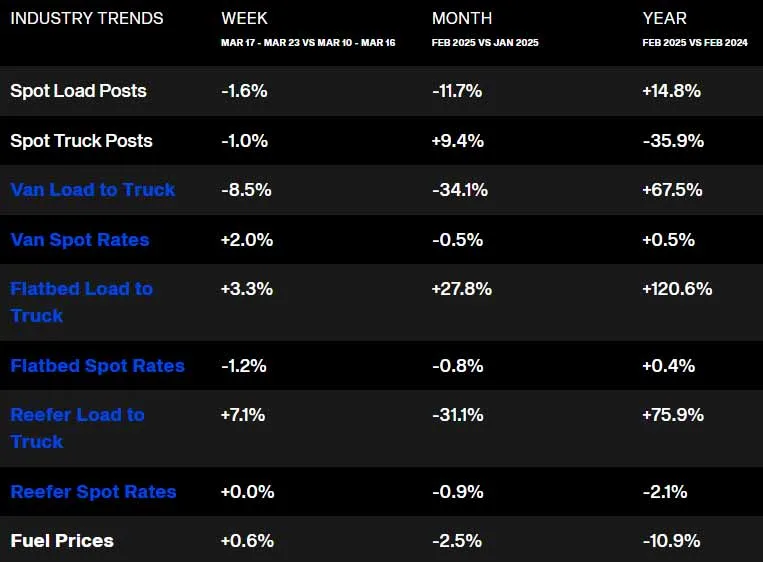

Load Board Activity and Market Trends

The DAT load board showed improving market dynamics on a year over year basis. Truck posts dropped 35.9% year over year. At the same time, load postings rose 14.8%.

These shifts pushed freight rates up slightly. Rates increased 0.5% compared to last year. Higher demand and tighter capacity contributed to this trend.

Flatbed load-to-truck ratios surged 120% year over year. Reefer ratios climbed 75.9%, while dry van ratios increased 67.5%. Despite higher demand, fuel costs dropped 10.9%. Lower fuel prices helped offset rising freight rates for carriers.

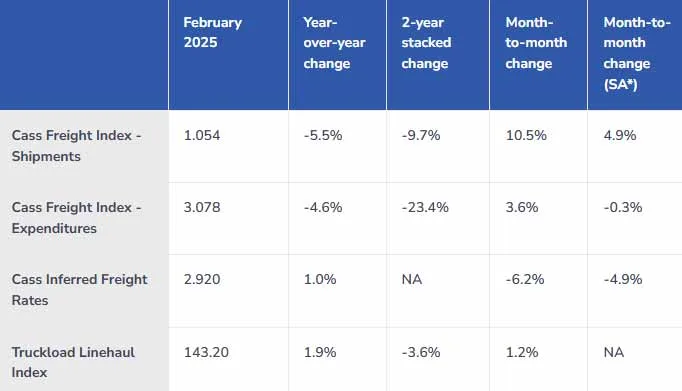

Cass Freight Index Shows Mixed Signals

The Cass Freight Index saw a rebound in February. Shipments rose 10.5% month-over-month, with nearly half of the gain coming from normal seasonality.

Year-over-year, the decline in shipments improved. February showed a 5.5% drop, better than January’s 8.2% decrease. Seasonally adjusted, the index climbed 4.9% month-over-month, reversing part of January’s 2.7% decline. Weather disruptions in January likely caused some of the month-to-month shifts. Pre-tariff shipping also played a role in February’s gains. However, this trend may reverse in March. Normal seasonality suggests a smaller 3%–4% year-over-year drop next month.

So again, the Cass Freight Index reported a 5.5% year-over-year drop in shipments. The index fell to 1.054 from 1.115. However, it recorded a 10.5% sequential increase from January’s 0.954 level. This suggests some recovery despite annual declines. Seasonality contributed to the sequential increase. Harsh January weather likely caused temporary shipment delays. February’s numbers benefited as those shipments resumed.

Some of the growth also stemmed from pre-tariff shipping. Shippers moved goods ahead of expected tariff increases. This temporary boost helped lift February’s figures. Freight spending increased in February. The expenditures component of the Cass Freight Index rose 3.6% month-over-month. However, the year-over-year decline widened to 4.6%, compared to January’s 4.2% drop. Lower shipment volumes explain the overall decline. Since shipments fell 5.5% year-over-year, rates effectively increased by 1.0% in February.

Future Outlook for Freight Markets

The recent tonnage increase signals a possible freight market recovery. Strong consumer demand and improving economic conditions may support continued growth.

Seasonal trends will influence upcoming months. March and April typically bring higher freight volumes. This could further boost tonnage and rate stability.

Shippers and carriers should watch for tariff changes and economic shifts concerning the manufacturing sector. These factors will impact freight volumes and pricing trends in the coming months.